Investing in student residences with Student Factory

Investing in student residences with Student Factory By purchasing an apartment in a Student Factory residence, you are choosing a long-term investment that will enable you to supplement your income with constant, secure rents, benefit from a defined return (1), and free you from the constraints of rental management (2).

A promising market

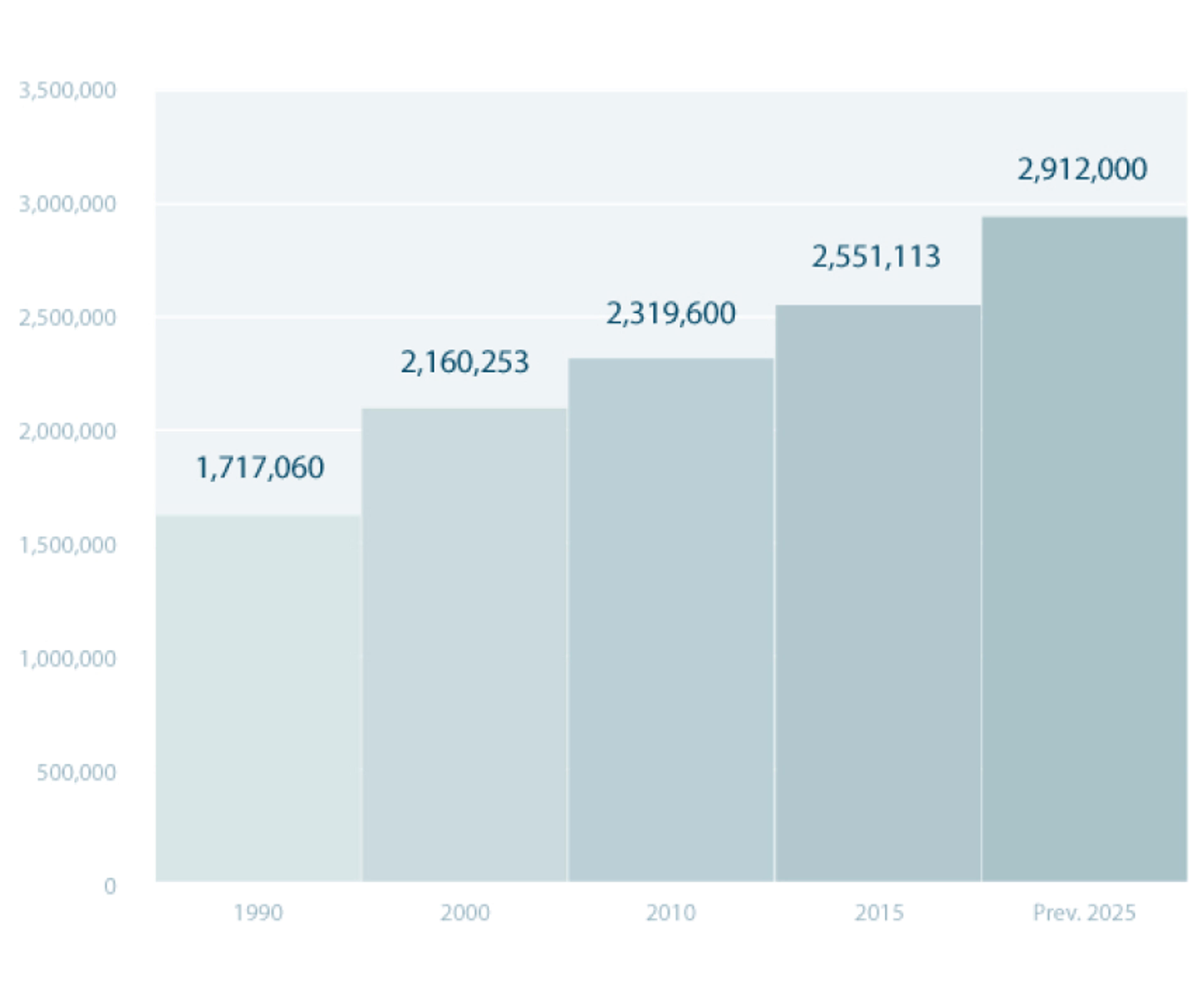

Higher education student numbers

Student population on the rise

There have never been so many students in France. With the increase in the number of baccalaureate holders, the lengthening of studies and the attractiveness of French universities and grandes écoles abroad, we are witnessing a considerable rise in the number of students in higher education: 3,000,000 students are expected in France by 2025*.

* Source: Ministry of Higher Education.

An insufficient supply of accommodation

The student residence market offers definite investment prospects for years to come. Despite the efforts of the public authorities, there is a shortage of suitable accommodation. Students are clearly finding it difficult to find accommodation, especially in large cities with their numerous higher education establishments. To meet this ever-increasing demand, 40,000 new student accommodation units would have to be built each academic year. In response, the government has introduced tax incentives to encourage private initiatives.

A safe and profitable investment

The advantages of investing in student residences

Investing in student residences often offers higher returns than traditional financial investments such as life insurance or Livret A savings accounts.

In fact, by investing with Student Factory, you can benefit from a profitability that is often higher than that of other financial investments, and which is defined as it depends on the rents received, themselves contractually fixed by the commercial lease (1).

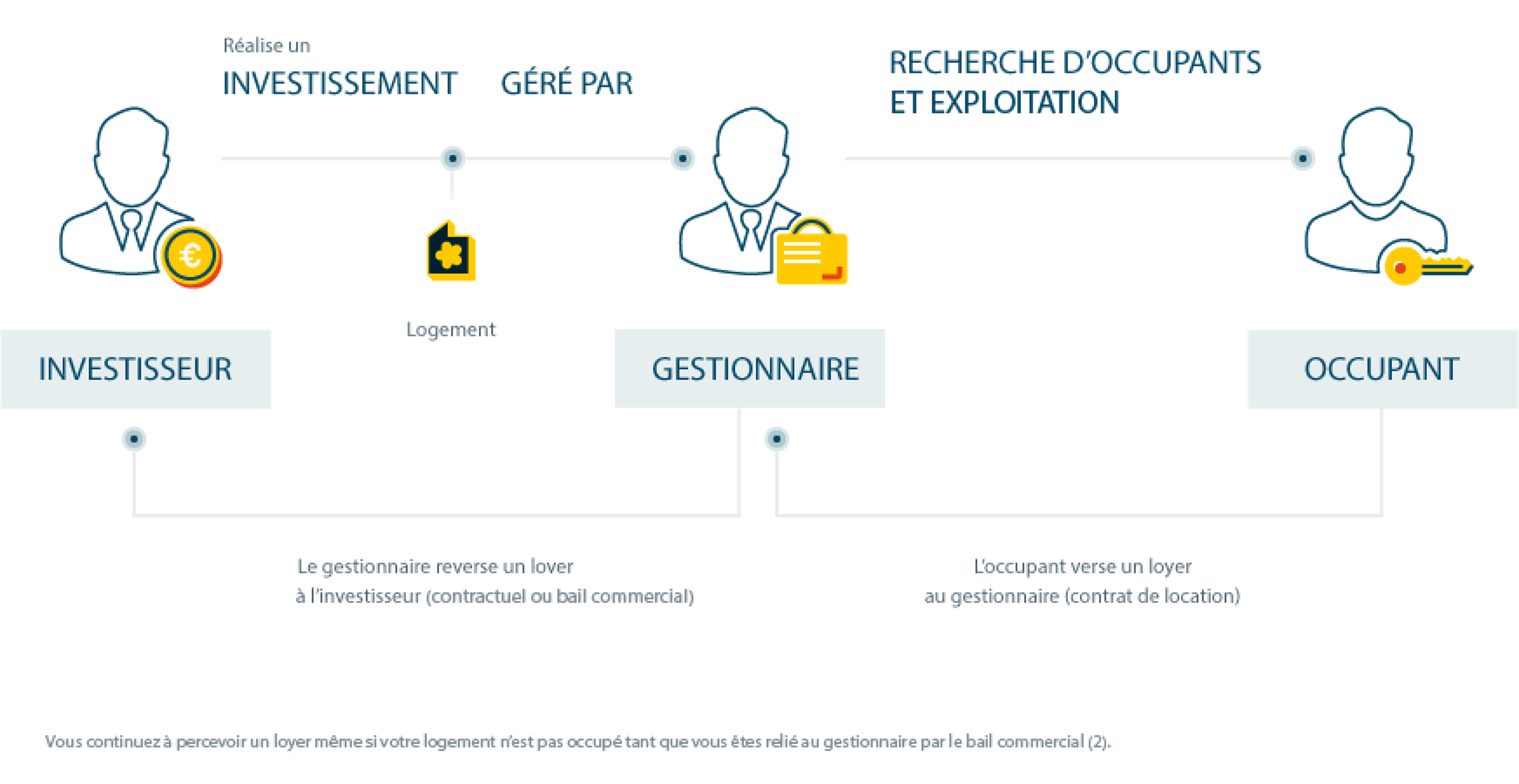

The manager's role

Investing in student residences with Student Factory By purchasing an apartment in a Student Factory residence, you are choosing a long-term investment that will enable you to supplement your income with constant, secure rents, benefit from a defined return (1), and free you from the constraints of rental management (2).

Student Factory a 100% VINCI Immobilier subsidiary

VINCI Immobilier has created STUDENT FACTORY, its own operating structure, to help you invest in student residences with peace of mind. VINCI Immobilier, the real estate subsidiary of the VINCI Group, is committed to continuous improvement and controlled development, and is present at every stage in the life of the residences to meet the expectations of local authorities, investors and students.

(1) Defined profitability

When buying a serviced residence, the profitability that depends on the rental income is defined by the commercial lease contract between the owner and the manager. The profitability of a property purchase in a serviced residence is calculated by dividing the rent received by the owner-lessor throughout the initial term of the commercial lease by the purchase price of the property, then multiplying the result by 100, subject to rent review under the terms of the commercial lease (other investment costs are not taken into account).

(2) Easy management

The property manager chosen by the property developer at the time of setting up the operation takes charge of managing the rental contract with the tenant and collecting the rent, at no additional cost to the owner.

(3) VAT recovery

The LMNP (Location Meublée Non Professionnel) Classique scheme and the LMNP Censi-Bouvard scheme allow VAT to be reclaimed on the purchase price, i.e. 20% of the property price excluding VAT. VAT is definitively acquired after 20 years of operation. If the property is sold or the eligible activity ceases before the 20-year period has elapsed, part of the VAT refunded must be returned in proportion to the number of years the property has been held.

(4) LMNP Classique

Under the classic LMNP scheme, non-professional furnished-rental property owners taxed under a simplified income tax regime may, subject to certain conditions, deduct certain expenses from their furnished-rental rental income (e.g. loan interest and insurance, property tax, condominium fees, notary fees and administration costs, guarantee fees). Non-professional furnished-rental owners taxed under a simplified "régime réel simplifié" can also deduct depreciation on the purchase price of movable property for 7 to 10 years, and real estate for 20 to 40 years, provided the property is recorded as an asset on their balance sheet. If the expenses deducted are greater than or equal to the rental income, the result of the balance is zero or a loss, which means that the non-professional lessor will not be taxed on his rental income. The status of non-professional lessor can be maintained as long as rental income is less than €23,000 per year, or does not exceed half the income of the investor's tax household, and when no member of the tax household is registered as a professional lessor. Eligibility for the LMNP Classique scheme is not guaranteed by VINCI IMMOBILIER, as the conditions of application are set and verified by the tax authorities. Further information is available from our sales advisors or at the following address : https://www.vinci-immobilier-investissement.com/investisseurs-lmnp/

(5) LMNP Censi-Bouvard

The LMNP Censi-Bouvard scheme enables taxpayers purchasing a property in a new service residence (student residences, establishments for dependent elderly people and senior residences) to benefit from a tax reduction equivalent to 11% of the total cost of acquiring the property. This tax break for new-build property is limited to a maximum of €300,000, including the price of the property and notary fees. This tax reduction is spread evenly over 9 years. Eligibility for the LMNP CENSI-BOUVARD scheme is not guaranteed by VINCI Immobilier, as the conditions of application are set and verified by the tax authorities. Further information is available from our sales consultants or at https://www.vinci-immobilier-investissement.com/investisseurs-lmnp/

(6) Investing with or without own funds

We invite you to contact a mortgage professional and/or a banking institution to accurately assess your eligibility for the scheme and your borrowing capacity.

- Student Factory

- Invest